Reprinted with permission from The American Association of Physician Leaders.

The nationwide shortage of anesthesiologists and certified registered nurse anesthetists (CRNAs) is a significant problem for hospitals and health systems in the United States because surgical services account for the bulk of hospital revenue. Physician leaders can help address this challenge by using their expertise in clinical operations, provider relations, and financial management to guide initiatives that support anesthesia recruiting and retention and ensure full anesthesia coverage. Key physician leadership objectives include optimizing the practice environment for anesthesia providers, mastering the economics of anesthesia practice, supporting anesthesia providers’ need to thrive professionally, and helping healthcare organizations adopt a flexible anesthesia recruiting strategy.

There is a shortage of anesthesia providers in the United States. The last major study of this issue in 2007 found a nationwide shortfall of 3,800 anesthesiologists and 1,282 certified registered nurse anesthetists (CRNAs).1 Since then, hospitals and recruiting firms have reported that the demand for anesthesia providers continues to significantly exceed the supply.2 Furthermore, recent trends will likely exacerbate this shortfall in the coming years. This is a significant problem for hospitals and health systems in the United States, especially as organizations struggle to emerge from the COVID19 pandemic.

The economics of the problem are simple. Hospitals rely on operating room (OR) procedure revenue for a major portion of both operating revenue and total margin. Hospital ORs, in turn, depend on the availability of quality anesthesia providers to deliver procedural services. As a result, any failure to recruit and retain an adequate anesthesia workforce could undermine the financial performance of the entire organization.

Because of its financial impact, the anesthesia shortage is (or should be) an executive level problem in every health system. However, the anesthesia workforce crisis goes beyond financial performance. It also affects clinical operations, care quality, patient access, and provider satisfaction. As a result, the anesthesia shortage is an issue that requires physician leadership.

Physician leaders can use a range of practical strategies to mitigate the impact of the anesthesia provider shortage. The first step is to understand the healthcare industry trends and professional dynamics that are driving the shortage in anesthesia expertise.

FACTORS DRIVING THE ANESTHESIA PROVIDER SHORTAGE

The anesthesia provider shortage mirrors the overall physician shortage in the United States, which is projected to reach between 37,800 and 124,000 primary care and specialty physicians by 2034.3 The groundbreaking 2010 analysis from the Rand Corporation estimated that the United States would experience a shortage of 4,479 anesthesiologists by 20204 — a shortfall of approximately 10% of estimated demand. (The data do not break down the shortfall by general anesthesiologists versus anesthesia specialists.)

Although there have been no comprehensive followup studies to validate this projection and quantify the current shortage, demographic trends, physician education statistics, and reports from healthcare recruiters indicate that the supply of anesthesia providers remains constricted and is likely worsening.2 According to data from the American Medical Association, there were 42,259 active anesthesiologists in the U.S. in 2019; of those, 23,049 (54.5%) were 55 or older. In comparison, the 55 or older rate among all physician specialties is 44.9%.5 This is especially concerning in light of expected retirements. A 2012 study found that the mean retirement age of anesthesiologists was 62.7 years and that the anesthesiologist work week decreased with physician age.6

At the same time, the demand for anesthesia providers is increasing. According to research commissioned by the Association of American Medical Colleges (AAMC), the overall demand for physicians — including specialists in anesthesiology — will grow faster than the provider supply for the foreseeable future.3

One useful measure of the demand for anesthesia services is the growing demand for surgical procedures, which is being driven by the growth of ambulatory surgery. Between 2008 and 2018, the number of outpatient surgeries performed annually in U.S. community hospitals increased by 7%.7

These macro trends are being exacerbated by several small-scale trends in the anesthesia professions. On the nursing supply side, a Doctor of Nursing practice will be required for new CRNAs starting in 2025, adding an extra year of training for nurse anesthetists. This extended course of training will reduce the number of new CRNAs who graduate every year for the next three years. On the physician supply side, it is estimated that fewer than 1,500 anesthesiologists complete a residency every year.8

In addition, there is anecdotal evidence that an increasing number of new anesthesiologists are choosing fellowship training in subspecialties such as critical care, cardiac anesthesiology, and pain medicine. This trend lengthens the training pipeline for anesthesiologists and reduces the number of fully productive providers who enter the workforce in any given year.

More recently, COVID-19 appears to be accelerating the anesthesia provider shortage. During the pandemic, the annual exit-from-practice rate (defined in terms of Medicare billing) among U.S. physicians 55 or older increased from 3.9% to 7.2%.9 This aligns with anecdotal reports that up to 5% of the anesthesia workforce chose to retire early, switch to an administrative role, or curtail their clinical hours during the COVID-19 pandemic. If data support this picture, it means the anesthesia workforce is closer to a crisis point than previously believed.

Reflecting all of these trends, anesthesia providers have become more difficult to hire. A large physician recruiting firm reported that between 2020 and 2021, anesthesiologists moved from 10th to seventh place on its list of most-recruited providers, and CRNAs moved from 13th to 10th place.8 The anesthesia provider shortage will likely bolster efforts to expand CRNA scope of practice within state legislation; however, these regulatory changes will not significantly impact the total supply of anesthesia providers. In any market, an imbalance between supply and demand can be resolved through rising prices. However, the reality of the anesthesia market is that the “price” of anesthesia services (principally provider compensation) is held in check by government policy. Medicare and Medicaid reimbursement rates for anesthesia services have declined steadily for nearly a decade. While commercial reimbursement is generally higher, it has followed the same pattern of reductions.

In response to this price imbalance, it has fallen to hospitals to make up the difference, and the prevalence of anesthesia stipends has increased steadily in recent years. Between 2002 and 2014, for example, the portion of nonacademic hospitals in California that provide direct financial support to an anesthesia group increased from 52% to 69%. During this period, the median payment jumped from $242,351 to $765,128.10

Because of the scope of this problem, the ability to navigate the anesthesia provider shortage will soon become a valued skill for physician leaders in most healthcare organizations. To meet this challenge, physician leaders should focus on a series of key actions: optimizing the practice environment for anesthesia providers, mastering the economics of anesthesia supply, supporting providers’ need to thrive professionally, helping healthcare organizations adopt a flexible anesthesia recruiting strategy and supporting increased third-party payment for anesthesia.

OPTIMIZE THE ANESTHESIA PRACTICE ENVIRONMENT

The anesthesia provider shortage is driven by macro-level trends in supply and demand. However, facility-level operational problems exacerbate the shortage by needlessly inflating the demand for anesthesia full-time employees (FTEs). As clinicians, physician leaders are in a unique position to identify these issues and work with providers and operational managers to resolve them.

The fundamental problem in most hospital ORs is misalignment between staffing and actual case volume, which typically results in overstaffing. The causes of this misalignment are complex, but one major driver is an ineffective surgery department block schedule.

Most hospital OR time is allocated to individual surgeons in 4-, 6- or 8-hour blocks, and 75% utilization is required to maintain block time. For example, an orthopedic surgeon might be allocated one room every Tuesday from 7:30 a.m. to 1:30 p.m. The surgeon essentially “owns” this dedicated weekly time in the OR. If the surgeon fails to schedule enough cases into that block, it can be hard for the OR to fill unused time on short notice.

From the hospital perspective, the immediate impact is low block time utilization, low revenue, and high nursing labor costs. From the perspective of the hospital’s anesthesia providers, low utilization is just as costly, because it forces the anesthesia group to devote more resources to fewer cases. In other words, 8 hours of OR time might produce only 4 or 5 hours of case time, but it will still require a full day of anesthesia coverage.

This inefficient use of provider resources exacerbates the anesthesia provider shortage. To address this issue and increase both anesthesia and hospital revenue, many hospitals and ambulatory surgery centers (ASCs) are now requiring an 80% utilization threshold to retain block time. Physician leaders can address this problem by helping anesthesia providers build a staffing model that reflects the realities of clinical scheduling in the OR. The key is to base the model not on the block schedule, but on actual case volume patterns. One effective strategy is to use data analytics to identify actual procedural volume and then revise the schedule to conform more closely to true demand.

The starting point is to query the OR information system for hour-by-hour utilization data for each OR room for the preceding 12 months. The next step is to calculate (to 95% confidence) the likely number of rooms utilized each hour of the day throughout the week. For example, an analysis might show a likely demand for 12 rooms during the 9 a.m. hour on Tuesday but only five rooms during the 3 p.m. hour on Friday. The anesthesia group can then schedule providers to meet actual fluctuations in demand on an hourly basis.

This will enable the group to deploy FTEs more efficiently, which will effectively reduce the demand for anesthesiologists, CRNAs, and other support staff. Higher utilization will also take pressure off anesthesia recruitment by allowing groups to cover more cases with fewer providers.

Any effort to improve anesthesia utilization must take into account not just the main OR, but also all non-OR anesthetizing (NORA) locations such as the cardiac catheterization lab, interventional radiology (IR), and endoscopy. Even in hospitals where the OR schedule is well designed, NORA sites are notoriously difficult to manage. These units are often dispersed throughout the hospital campus, creating logistical difficulties for anesthesia coverage. In addition, most NORA sites operate independently from the main OR, an organizational barrier that can be difficult to surmount when trying to coordinate anesthesia coverage.

Physician leaders can help address this problem by acting as a liaison between anesthesia providers and the NORA clinicians they support. The first step is to work with department leaders to get all NORA sites into the master OR schedule. This will give the anesthesia group a comprehensive view of the total demand landscape, which will allow them to begin deploying FTEs more efficiently hospital-wide. It will also enable physician leaders to work with other departments to begin consolidating NORA procedures into regular blocks.

For instance, in many hospitals, IR procedures that require anesthesia support are scheduled sporadically throughout the week, forcing anesthesiologists and CRNAs to interrupt their OR schedule frequently to cover these cases. Grouping all non-emergent IR cases into (for example) a Wednesday afternoon block will enable the anesthesia group to cover more volume with the same number of FTEs. Freeing up anesthesia provider work hours by managing anesthesia demand will not solve the underlying challenge of the national provider shortage. It will, however, help hospitals and anesthesia groups absorb the impact of the shortage.

What about the political obstacles to effecting change in the OR? Experienced physician leaders know that issues like block schedule redesign can unlock deep-seated differences between surgeons, administration, OR nursing management, and anesthesia providers. The only way to overcome these differences is to create a multidisciplinary Surgical Services Executive Committee (SSEC) to manage the OR.

The role of an effective committee is discussed below. The key point here is that a well-functioning SSEC pro- vides physician leaders with the ideal forum for solving the operational problems that aggravate the anesthesia provider shortage.

MASTER THE ECONOMICS OF ANESTHESIA

The economic fundamentals of anesthesia coverage have not changed much in the past few years. That said, the anesthesia provider shortage has shrunk the “margin of error” that separates a functioning economic model from an unsustainable system. Well-rounded physician leaders can use their clinical experience and financial perspective to help hospitals get more sophisticated about several aspects of anesthesia economics.

Anesthesia coverage models. Transitioning from physician-only anesthesia coverage to a physician/CRNA care team model can allow a hospital to lower the cost of anesthesia services and ensure full coverage. Hospitals that initiate this move, however, often run into resistance from anesthesiologists. Physician leaders should focus on finding common ground between the professional goals of the anesthesia group and the economic needs of the hospital.

- Understand the relevant state regulations governing anesthesia practice. In the past decade, many state legislatures have significantly increased allowable physician- to-CRNA practice ratios.

- Identify the practice preferences of the hospital’s current anesthesia providers. Some anesthesiologists have no interest in team care; others are open to working in a directing or supervising capacity.

- Analyze the hospital’s case mix to estimate the number and type of cases that could be covered through a care team model. Note that it is possible to stratify cases to different anesthesia coverage models. For instance, a hospital might use low-ratio anesthesia medical direction to cover high-acuity cardiac cases while leveraging a high-ratio “zone model” to cover low-acuity gastrointestinal procedures.

- Project the billing implications of different care team models. In addition to “physician-only” care and non-directed “CRNA-only” care, the models are medical direction (one physician directing up to four CRNAs), medical supervision (one physician supervising from five to eight CRNAs), resident supervision (one physician supervising up to two medical residents), and student nurse supervision (one physician supervising up to two SRNAs). Each model impacts provider reimbursement in a different way.

Settling on a model that is acceptable to all parties requires discussion, negotiation, and compromise. However, the right model or combination of models will ensure the appropriate level of care for different patient cohorts, increase the professional satisfaction of anesthesia providers, stretch physician resources, and help secure a full anesthesia workforce.

Anesthesia reimbursement. Reimbursement is a major factor in anesthesia recruiting, and reimbursement levels largely determine whether a hospital must provide financial support to its anesthesia providers. There is no difference in reimbursement between independent and employed anesthesia providers; however, anesthesia reimbursement varies widely by payer, which makes it difficult for hospitals to assess the financial situation of their anesthesia partners.

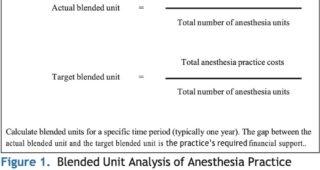

One versatile tool for analyzing anesthesia provider reimbursement is the blended unit, which can be broken down into the actual blended unit and the target blended unit (see Figure 1). An anesthesia group’s actual blended unit is its average per-unit reimbursement across all payers. The group’s target blended unit is the average reimbursement it needs to achieve financial sustainability.

One versatile tool for analyzing anesthesia provider reimbursement is the blended unit, which can be broken down into the actual blended unit and the target blended unit (see Figure 1). An anesthesia group’s actual blended unit is its average per-unit reimbursement across all payers. The group’s target blended unit is the average reimbursement it needs to achieve financial sustainability.

To calculate a target unit, divide total anesthesia practice costs (including provider compensation, malpractice insurance costs and billing costs) by the total number of anesthesia units billed annually (available from the anesthesia billing system). Based on our assessments of anesthesia revenue in several hundred healthcare organizations, anesthesia providers serving a typical community hospital (24-hour OR coverage, active obstetrics service, full range of endovascular suites, etc.) without an ASC will require a blended unit of approximately $60 to $70 to ensure a financially self-sustaining practice.

Physician leaders and other executives can use blended unit calculations to achieve two goals.

First, the gap between the target blended unit and the actual blended unit is essentially the financial support that anesthesia providers require to provide services. Therefore, blended unit analysis enables physician leaders to determine whether an anesthesia group requires a financial stipend and how much financial support is appropriate.

Second, blended unit analysis backed by solid data can be useful during contract negotiations with commercial payers and large self-insured employers. The target blended unit is essentially the true cost of providing anesthesia services in a specific market. Given the increasing difficulty of recruiting anesthesia providers, it is not a theoretical number but a true requirement of providing surgical care to insured members and employees.

In the years ahead, as the lower-reimbursed Medicare population expands, careful attention to the blended unit will be critical to maintaining adequate overall reimbursement levels for anesthesia providers.

Anesthesia compensation. Physician leaders can help anesthesia groups and hospital executives adopt a more sophisticated approach to anesthesia compensation benchmarks. National compensation benchmarks (such as benchmark data available from the Medical Group Management Association and Sullivan Cotter) provide a valuable starting point. However, all benchmark data are at least one year old, and most datasets fail to capture regional variation in pay. Healthcare leaders need to take a flexible approach to anesthesia compensation.

- Recruiting strategy should focus on the local nature of compensation. For example, the national median pay for anesthesiologists might be $400,000, but if a local competitor is paying $415,000, every other organization in the market needs to match or beat that figure.

- Leaders should understand that the current anesthesia provider market is extremely volatile. In our experience, some markets have recently seen anesthesia compensation adjustments every two months. In one Northeastern metropolitan area, median CRNA compensation recently increased approximately $70,000 in one year and median anesthesiologist compensation increased $90,000.

- Anesthesia compensation design also calls for a “local” approach. Several compensation models are available for anesthesia practices, and each offers benefits in terms of provider alignment with organizational goals. However, the starting point of designing an effective compensation plan is provider preference.

Physician leaders should work with anesthesia providers to understand their priorities. For example, some groups might want to maximize income through an aggressive anesthesia unit-based compensation model. Others might prefer a balanced model that takes into account non-compensated work on clinical quality, performance improvement and other objectives.

SUPPORT GOALS AND ASPIRATIONS

Adequate compensation and an efficient working environment are essential, but they are only part of a strong anesthesia recruiting and retention strategy. Hospital and anesthesia group leaders also need to work together to create an anesthesia practice environment that meets providers’ needs for professional growth. In this area, physician leaders can play a unique role by understanding and advocating for the professional aspirations of anesthesia providers.

Once they have mastered clinical care, most anesthesia providers want to engage with new professional challenges. Several options are available. For example, anesthesia providers can be appointed to lead the development of enhanced recovery after surgery (ERAS) protocols. These initiatives allow anesthesia professionals to use their expertise in perioperative processes to make an impact on patient outcomes.11 Similarly, anesthesia providers can play a key role in designing perioperative surgical home (PSH) models12 and developing centers of excellence around various surgical service lines.

Looking specifically at CRNAs, it is important that nurse anesthetists be allowed to practice at or near the top of their license. Depending on the jurisdiction, this might include performing nerve block procedures for surgical patients and epidural pain blocks for obstetric patients. Both anecdotally and in our experience, will leave hospitals with restrictive work environments and seek out employment opportunities that allow a full scope of practice.

Anesthesia providers also can be introduced to operational leadership opportunities. A traditional leadership opportunity for new anesthesiologists is participation in medical staff committees. In addition, in many better-performing hospitals, an anesthesiologist co-manages the perioperative services department in collaboration with the OR nurse manager. This is an opportunity for enterprising providers to take responsibility for the efficiency and outcomes of the entire OR.

Anesthesia providers can play a critical role in a Surgical Services Executive Committee (SSEC), an OR governance structure that is common in better-performing surgery departments. An SSEC is an operational “board of directors” for the OR that includes representatives from the surgeon staff, the anesthesia department, nursing leadership, and hospital administration.

Significant improvements in OR operations and efficiency are not feasible without the leadership of an SSEC. For example (as discussed above) an SSEC can provide a multidisciplinary forum for discussing block schedule allocations and developing a new block system that balances the needs of surgeons, anesthesia providers and hospital leadership.

The involvement of anesthesia providers in an SSEC can also prevent problems that directly impact coverage issues. For instance, it is not uncommon for executives to create a new surgical service line without first consulting their anesthesia partners. The anesthesia group is expected to adjust to the new workload with little advance notice. When service line decisions are managed through an SSEC, anesthesia leaders have the opportunity to assess the impact on provider capacity and make sure their voice is heard on any changes that affect anesthesia coverage.

DEVELOP A FLEXIBLE RECRUITING STRATEGY

- Develop a detailed assessment. A proactive approach to anesthesia workforce planning requires a three-year projection of both supply and demand.

On the supply side, the projection should identify which anesthesia providers will be retiring and which are at risk of leaving the group. In our experience, even well-functioning anesthesia groups currently are seeing 20% annual turnover — most of which is unexpected. Physician leaders can become more aware by facilitating candid peer conversations regarding professional goals and personal needs.

On the demand side, the projection should cover expected trends in procedural volume. Here, physician leaders can provide valuable input on trends in procedural care that affect anesthesia demand.

- Focus on the talent pipeline. To be successful in today’s competitive anesthesia provider market, recruiting efforts need to begin further upstream. One option is to offer financial support to anesthesia providers-in-training in exchange for a three-year commitment to practice. This will provide at least temporary support for full anesthesia coverage, with the likelihood that several of these short-term providers will become long-term

Another option is to establish a CRNA training program.13 This strategy can be especially useful for hospitals that are committed to building a team model of anesthesia coverage.

- Adopt a strategic recruiting mindset. Traditionally, anesthesia groups have focused on recruiting lifetime partners. The severity of the current shortage makes this goal unrealistic. While practices still need a core workforce of long-term providers, recruiting efforts today should also focus on simply “filling up shifts.”

Consider this scenario: The leaders of an anesthesia group become aware of a provider who recently moved into their area: an anesthesiologist married to another physician who is starting a fellowship at a local academic center. The couple’s ultimate destination is uncertain, so the anesthesiologist cannot commit to anything longer than a two-year contract.

In the past, the practice would probably not consider this candidate — partly because they want to build a long-term team and partly because the group’s malpractice coverage would be too expensive for this provider. In today’s market, however, when most groups are having trouble covering their contractual obligations, it makes sense to engage this provider even if he or she will be available only a few years.

Similarly, anesthesia group leaders should discard the “one size fits all” approach to employment contracts and offer a range of flexible options. In our experience, today’s anesthesia workforce includes a high proportion of young parents who can cover regular shifts but cannot accommodate chaotic schedules. To secure these providers, hospitals and anesthesia groups must offer a variety of full-time, part-time, per diem and “no call” arrangements.

- Hold a regular workforce review. The anesthesia provider shortage is not only severe, but also it is evolving rapidly. For these reasons, hospital and practice leaders need to monitor the situation closely and be prepared to make frequent course corrections.

Physician leaders can support this effort by leading a regular anesthesia workforce review. The review work-group should include hospital executives, anesthesia practice leaders, OR nursing management and representative surgeons. On a regular basis, these stakeholders should assess current anesthesia coverage, review recruiting plans and provider retention activities, and identify priorities and action items for ensuring a full anesthesia workforce.

The workgroup should meet at least annually, but in organizations with severe challenges it could meet as often as monthly to make sure anesthesia workforce issues remain front and center for the entire n.

CONCLUSION

Physician leaders can play a key role in helping healthcare organizations weather the anesthesia provider shortage. Many of the issues discussed here are specific to anesthesia practice; however, providers in any specialty can use general physician leadership competencies — particularly communication skills and knowledge of organizational dynamics — to effect change.

Leveraging their expertise in clinical operations, provider relations and financial management, physicians in leadership positions can help create the operational, financial and professional models needed to drive strong anesthesia recruiting and retention and ensure full anesthesia coverage.

Going forward, physician leaders should stay attentive to trends within the anesthesia provider community that are evolving in the aftermath of the COVID-19 pandemic, including emerging migration patterns and changing priorities for work-life balance.

REFERENCES

- RAND Health Research Highlights. Is There a Shortage of Anesthesia Providers in the United States? Santa Monica, CA: RAND;2010.

- Birk S. Looming Anesthesiologist Shortage Fuels High Market Demand. Anesthesiology News. August 13, 2019.

- IHS Markit Ltd. The Complexities of Physician Supply and Demand: Projections from 2019 to 2034. Washington, DC: AAMC;2021.

- Daugherty L, Fonseca R, Kumar KB, Michaud P-C. An Analysis of the Labor Markets for Anesthesiology. Rand Health Q. 2011;1(3):18. eCollection 2011

- Physician Specialty Data Report: Active Physicians by Age and Specialty, 2019. Association of American Medical Colleges. www.aamc.org/data-reports/workforce/interactive-data/active-physicians-age-and-specialty-2019. Accessed April 14, 2022.

- Orkin FK, McGinnis SL, Forte GJ, et al United States Anesthesiologists Over 50: Retirement Decision Making and Workforce Implications. Anesthesiology. 2012;117(5):953–963. doi:10.1097/ ALN.0b013e3182700c72

- American Hospital Association. TrendWatch Chartbook 2020. Washington, DC: AHA;2020.

- Merritt Anesthesiology: Supply, Demand and Recruiting Trends. Dallas, TX: Merritt Hawkins;2021.

- Neprash HT, Chernew ME. Physician Practice Interruptions in the Treatment of Medicare Patients During the COVID-19 JAMA. 2021;326(13):1325. doi:10.1001/jama.2021.16324

- O’Connell C, Dexter F, Mauler DJ, Sun EC. Trends in Direct Hospital Payments to Anesthesia Groups. Anesthesiology. 2019;131(3):534–542. doi:10.1097/ALN.0000000000002819

- Moningi S, Patki A, Padhy N, Ramachandran Enhanced Recovery After Surgery: An Anesthesiologist’s Perspective. J Anaesthesiol Clin Pharmacol. 2019;35(Suppl 1): S5–S13. doi:10.4103/joacp. JOACP_238_16

- Kash BA, Zhang Y, Cline KM, Menser T, Miller TR. The Perioperative Surgical Home (PSH): A Comprehensive Review of US and Non-US Studies Shows Predominantly Positive Quality and Cost Milbank Quarterly. 2014;92(4):796–821. doi:10.1111/1468-0009.12093

- Wachtel RE, Dexter Training Rotations at Hospitals as a Recruitment Tool for Certified Registered Nurse Anesthetists. AANA J. 2012;80(4 Suppl):S45-48.

![]()