Removing Roadblocks to Unleash the Full Potential of Ambulatory Surgery Care

Demand is Overwhelming Surgical Services

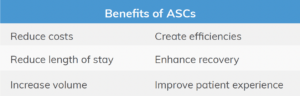

ASCs are key for increased volume at a lower cost

The nation’s surgical market is booming. This is accelerated by a growing senior population and recovering surgical volume (including elective procedures) after the pandemic.

Until recent years, most surgeries were performed in hospitals, especially procedures that were considered more complex. However, with advancements in technology and care pathways, The Centers for Medicare & Medicaid has approved an increasing number of procedure types—including more intricate spine and orthopedic cases—to be performed in an outpatient setting.

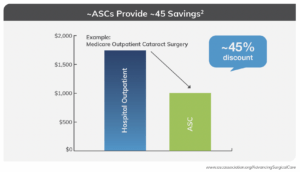

ASCs have excelled at optimization; with hospitals now proving to be much less efficient than the ambulatory environment. This focus on efficiency drives volume without compromising on quality and safety. Evidence has shown ASCs result in cost savings of nearly 45%1 for the same procedure performed in a hospital—showcasing why the nation should be prioritizing solutions for ASCs to enable a major site-of-service shift for surgical services. This creates a win-win scenario for patients and healthcare as a whole.

Hurdles to Growth

Challenges that complicate a site-of-service shift

Unfortunately, healthcare—and anesthesia specifically—face challenges that interrupt the transition of appropriate cases from the hospital to the ambulatory setting. Additionally, ASCs are not immune to the pressures touching all operating rooms (ORs) today. There are three main drivers of these challenges, which are circular in nature.

Staffing Challenges

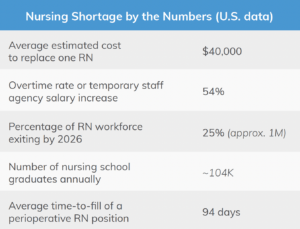

The tight labor market leads to inadequate staffing of trained professionals in nursing, technical areas, such as sterile processing, and anesthesia. This problem is projected to affect medicine for the next decade, if not longer. The pandemic hastened retirement for many individuals nearing the end of their careers, especially in anesthesia and nursing.

With fewer new graduates entering the workforce in these specialties, combined with lengthy training requirements, there are fewer overall providers working today. This results in higher clinical compensation to match the demand, and higher rates of burnout for the staff who remain in the workforce. Hospitals and ASC alike are experiencing greater staff turnover and longer periods of vacancy. This affects both revenue and volume.

The anesthesia landscape specifically has changed dramatically in the last two years. In 2021, anesthesiology lost roughly 7,459 physicians, which was nearly 17% of the workforce (4). Without anesthesia, there is no surgery. The field of nursing faces a similar, if not greater, loss of talent.

With overworked surgical teams and the use of temporary staff, ASCs can also increase the risk of patient safety events2. Furthermore, reduced staff threatens the operational efficiencies typically expected in the ASC environment. This lessens the overall satisfaction rates of providers and patients.

Payor and Revenue Challenges

Evolving payment models, such as fee-for-service and value-based contracts, facility fee versus professional fee, routine cost negotiations, and soaring clinical compensation further challenge the ASC environment. Knowing a high percentage of surgical procedures could be performed at a lower cost outside of the hospital has accelerated payors’ interest in ambulatory centers over more expensive hospital services; in some cases, payors are demanding this site shift.

However, even in an ambulatory center, the revenue does not always align with the actual cost of providing care. While it varies by market, ASCs are not immune to the rise in per diem or locum roles, which can offer more flexibility for the clinician, and even higher compensation. In anesthesia specifically, pay rates are rising faster for certified registered nurse anesthetists (CRNAs) than anesthesiologists, which also puts the care team model at risk.

Furthermore, payors continue to reduce clinician reimbursement rates. This is especially true for Medicare, which has paid unsustainable anesthesia services rates3 for decades and is a primary payor for many in the largest age group now seeking surgical care. In anesthesia, this is specifically troublesome, since Medicare bases its current anesthesia reimbursement on a flawed initial formula that treats the specialty equal to all others. However, while surgeons bill by procedure type, anesthesia bills based on a process that is individualized to each patient’s level of illness, time spent delivering care in the OR, and the type(s) of anesthesia provider(s) managing the case. Failure to account for the intricate billing process in anesthesia means that, on average, other specialties receive roughly 80% of their commercial rate from Medicare, while anesthesia’s Medicare reimbursement rate is less than 33% of the commercial payor rate. Based on these unbalanced reimbursement rates, anesthesia services may have to bill and collect for a minimum of six cases per day simply to cover its costs before any profit margin begins.

Hospitals, ASCs, and other service providers (or venues for services) are now also competing for an already diminished workforce pool. As labor costs—specifically in anesthesia—surpass payor rates, facilities face increased subsidies to offset the cost of providing clinical services itself. To contain costs, especially in anesthesia, some facilities are choosing to bring their anesthesia specialty back in-house. When facilities bring providers in-house and hire them directly, existing anesthesia groups in that area that may service multiple sites frequently face workforce challenges and an inability to find local providers. This results in terminations of anesthesia group contracts—often with short windows of notice.

Capacity Influx

Finally, our nation’s aging population is expanding. The World Health Organization4 estimates by 2050, the percentage of people over age 60 will have increased nearly twofold. Innovations in technology and medicine enable older and sicker patients to survive and thrive post-operatively. With a higher percentage of surgical procedures being approved for outpatient care, and a surge in elective cases following the pandemic, ASCs are facing this demand. While an increase in volume should be a benefit, similar to hospitals, ASCs face the growing inability to hire and retain staff to keep pace with demand, coupled with low reimbursement rates and higher compensation costs.

As hospitals pull back providers and cases, and ASCs are unable to staff their ORs or sustain profitability, surgical services are at a crossroad. While the desire remains strong to move cases to outpatient settings, a reverse migration of care is starting to be seen instead—shifting cases back into the higher cost hospital settings where the anesthesia care is available.

ASC Optimization Solutions

Strategies to Create Operational Efficiency

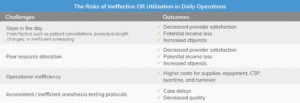

Beyond the known market pressures, ineffective OR operational management and utilization within surgical services (regardless of location) can further affect long-term competitiveness and financial stability. A facility with a reputation of poor OR operations and low utilization may dissuade surgeons and patients from their service. Moreover, avoidable negative impacts on clinical providers’ daily routine can reduce overall provider satisfaction and harm retention.

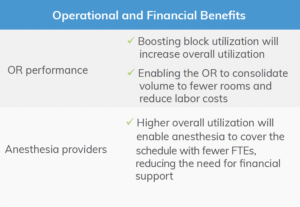

It is also important to note that many of the factors driving profitability and revenue for anesthesia groups are not within that group’s control, such as scheduling, room utilization, payor and procedure case mix, coverage requests, or the labor market itself. Creating efficiencies within facilities—driven by facility leaders who structure days that enable anesthesia providers to drive volume, cover their costs, and grow revenue—can meaningfully improve anesthesia provider experience.

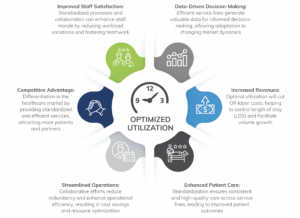

Using a comprehensive strategy, surgical services can enhance patient pre-surgical preparation and align staff levels with predicted volumes based on predictive analytics. By adopting advanced tools and methods, surgical services can enhance coordination, reduce idle downtime, and create a more predictable workflow. This empowers anesthesia providers, increasing their satisfaction, and ideally increasing volume and profitability across the board.

The Journey to Improved Utilization

All healthcare understands that the status quo is not sustainable. The process of improving utilization begins by reducing white and red spaces in the schedule, leading to:

- Enhanced scheduling practices

- Optimized block time allocation

- Reduced delays and turnover times

- Improved demand forecasting through data analytics

- Enhanced patient pre-surgical preparation

- Increased use of predictive analytics to staff for volume

- Increased patient provider and staff satisfaction

These efforts aim to maximize OR efficiency, improve patient care, enhance job satisfaction among healthcare providers, and ultimately contribute to a healthier bottom line for the department.

4 Strategies Focused on Financial Benefit

1. Optimize perioperative services by eliminating white spaces to reduce scheduling gaps

- Right-size surgeon block access with 75% hospital utilization

- Create a 20% dedicated capacity for non-operating room anesthesia (NORA), emergent, and add-on volume

- Appropriate scheduling and distribution of cases between NORA, ASC, and Hospital

2. Position anesthesiology as a focal point to address allocation challenges

- Develop provider scheduling/assignments based on data-driven demand pattern

- Routinely assess anesthesia provider pay against the market

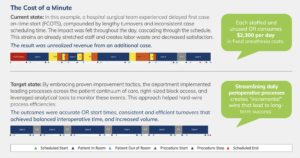

3. Reduce operational inefficiency costs

- Drive processes that improve start times and shorten turnover times

- Create a collaborative daily huddle and review process that proactively manage patient cases

4. Establish anesthesia-driven protocols

- Create a standardized person specific outcome (PSO) testing process

- Streamline patient contact and establish standardized expectations

- Implement standardized care pathways

Benefits of Optimized Utilization

Higher utilization reduces costs, creates efficient operations, and lays a solid foundation for seizing multiple opportunities.

Learn more with our webinar: Finding Win-Wins for Surgical Services During the Anesthesia Crisis